Never settle your loan! Secure your credit score.

Never settle your loan! Secure your credit score.

That’s right! First thing to remember, “settlement” of your loan or credit card debt is not resolving the issue. It resolves the issue for the bank or the credit card issuer but creates a long-term credit worthiness issue for you.

A lot of people mistake settlement for closure, but it’s not. When you “settle” your loan account or credit card at a discounted value of the due amount, the bank gives you a NO DUES letter to show the settlement is done but in your credit report, it shows a “recovery”, which translates to say that you didn’t intend to pay, and the bank recovered the money from you. This can lead to you not getting a loan or a credit card for the next few years and your credit score drops several notches.

What should you do to safe guard your credit score?

Here is a typical example of how the story unfolds.

Suppose you have taken a personal loan and/or have a credit card debt. Unfortunately, due to whatever reasons, the repayment was not being done on time and the dues are piling up. The credit card reaches its limit and/or the personal loan instalment dues are piling up. Your failure to repay could be for various unforeseen reasons, like an illness, some personal setbacks, a family emergency, or even sheer negligence. It could be any reason. In most cases, the banks will constantly follow up with you and chase you to recover the dues.

As a responsible customer communicate with the bank and request for additional time to repay. Given the repayment history, the bank may give some extra time and reduce the amount due for a one-time settlement. Which means you are expected to pay the lower value in one go on a pre-decided date. Sometimes the banks may even give a structured EMI option for the reduced amount. Remember that this doesn’t happen straightaway. The banks will not immediately agree to providing you with extra time. You must maintain all communication in writing so that you have records of every communication with the lender. This is very important.

Here is the trap: While discounted settlement looks like an easy route to peace, this is the end of the road for any future financial plans or credit. It’s a bait. Don’t ever agree to it, unless you have no other alternative. (There is always an alternative). The alternative option may be a longer and more difficult route, but this will help you improve your credit score faster.

Difference between “Settled” loan & “Closed” loan in your credit history

While negotiating the repayment terms for your loan or credit card debt, discuss the details clearly with the lender. The lenders will usually give you a 6-month non-payment period if they find your reasons genuine. However, they may insist on one single payment for the entire due after the 6 months period. They may also offer a waiver on the amount to make it easier to recover their loans.

However, if you opt for the discounted value to repay, the lender will gladly agree but usually, report to the credit rating agencies as “SETTLED” which in other words means the money was “recovered from you”. Recovery essentially means that you were unwilling to pay and that will affect your credit score immensely. In some cases, you will never ever be eligible for any loans going forward.

On the contrary, if you agree to pay the entire due in smaller parts over a longer period, the lender will report to the credit rating agency as “Closed” (once your loan is repaid) which means, you willingly paid the money and the intent to pay is clearly demonstrated. This will also influence your credit rating but recovering from here is far easier and faster.

Credit Score and impact of “Settlement” on your score.

When a part of your loan is reduced and you repay the reduced amount, the lender will most certainly report the same to CIBIL and other credit rating agencies. This will reflect as “Settled” against your loan and a settlement is seen as a negative credit behaviour. Most lenders will read this as high-risk customer and will decline any loan that you may apply for. In doing so you as a borrower will see your credit score drop. Furthermore, every time you apply for a loan, the details reflect in your credit report. A lenders will see the number of times you have applied for loans and the number of times it has been declined. This leads to further reduction of your chances to get a loan.

Don’t forget that each time you apply for a loan, you lose a few points in your credit score. It’s a slippery slope and you will need to navigate this very carefully.

Dealing with a poor credit score and ways to improve your credit score.

When you “Settle” a loan, as a borrower you may see this as an opportunity to pay less and close the loan. But each time you do this, the lender will communicate the closure as a “recovery” more than a loan repaid voluntarily. Recovery is a negative in your credit report. Every loan settlement will put you back by at least 7 years for any chances to get a loan. Most borrowers are not aware of this and gladly agree to a settlement.

If you have a loan that has come to a point of settlement, always try to find a way to clear the amount in full. Use your savings, investments or borrow from friends and family, but never ever go for a discounted settlement. Settlement should be your last resort always. Not the first.

How to recover from a poor credit score and become credit worthy again?

There are various options available. We will tell you how, based on the severity of the case. Sign Up and we will help you improve your score within 6 to 12 months.

Precautions & Safety for your Credit Score

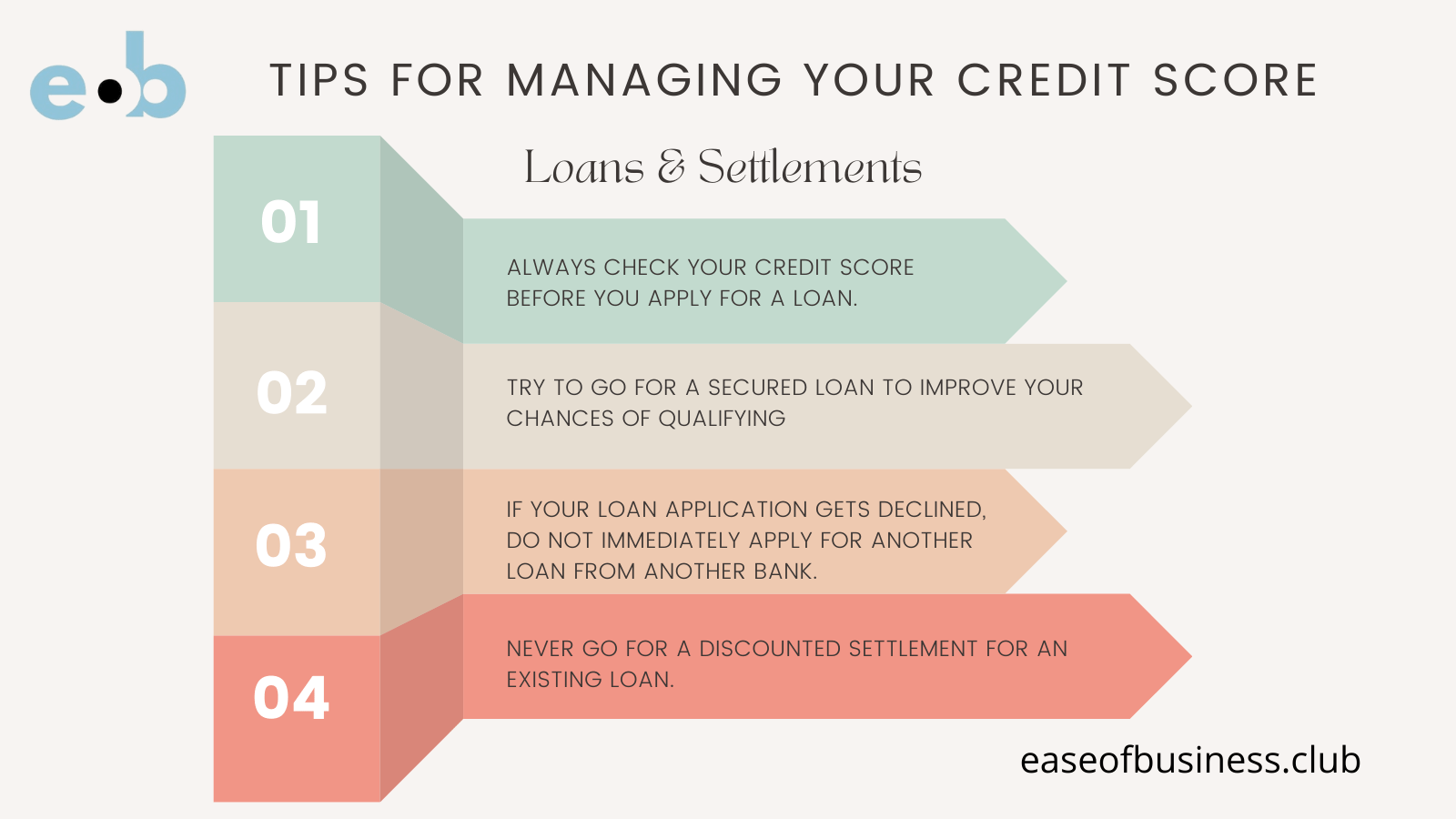

- Always check your credit score before you apply for a loan. If your score is below 720, do not apply for a loan. The chances of qualifying are slim and each time you apply for a loan, your credit score goes further down.

- Try to go for a secured loan to improve your chances of qualifying if your score is below 720.

- If your loan application gets declined, do not immediately apply for another loan from another bank. Your credit report is shared by all lending institutions almost in real time. Decline by one will only spoil your chances for the next.

- Always borrow only as much as you can repay.

- The moment you “Settle” your loan, your credit score will drop substantially, and, in most cases, you won’t qualify for a loan for at least 7 years. That’s a long time if you are in business.

To lean more, you can visit the CIBIL website and sign up for a plan to check your credit score regularly and check if any bank has reported your delays in loan repayment. It’s worth the effort since it has a long-term impact on your credit score.

Of course, there is help at hand. In case you are caught in a difficult situation like that, EOB can assist you in improving your score. Ask us how. But like we said, never settle your loan! Secure your credit score.